If you’re doing your accounting by hand, the trial balance is the keystone of your accounting operation. All of your raw financial information flows into it, and useful financial information flows out of it. At some point, you’ll want to make sense of all those financial transactions you’ve recorded in your ledger. The next step is to record information in the adjusted trialbalance columns. The adjusting entries in the example are for the accrual of $25,000 in salaries that were unpaid as of the end of July, as well as for $50,000 of earned but unbilled sales. The adjustments need to be made in the trial balance for the above details.

Mục Lục

AccountingTools

Next you will take all of the figures in the adjusted trialbalance columns and carry them over to either the income statement columns or the balancesheet columns. Once the trial balance information is on the worksheet, the nextstep is to fill in the adjusting information from the postedadjusted xero integration journal entries. Total revenues are $10,240, while total expenses are $5,575.Total expenses are subtracted from total revenues to get a netincome of $4,665. If total expenses were more than total revenues,Printing Plus would have a net loss rather than a net income.

Unit 4: Completion of the Accounting Cycle

Thisnet income figure is used to prepare the statement of retainedearnings. In these columns we record all asset, liability, and equity accounts. There is a worksheet approach a company may use to make sure end-of-period adjustments translate to the correct financial statements.

Accumulated Depreciation Explained

In this case we added a debit of $4,665to the income statement column. This means we must add a credit of$4,665 to the balance sheet column. Once we add the $4,665 to thecredit side of the balance sheet column, the two columns equal$30,140. The statement of retained earnings (which is often a componentof the statement of stockholders’ equity) shows how the equity (orvalue) of the organization has changed over a period of time.

Find out if you can receive wire transfers to your PayPal account and learn about alternative methods for receiving money. Discover the best business bank accounts for sole proprietors in 2025, comparing top banks to help you find the perfect fit for your needs. Financial statements give a glimpse into the operations of a company, and investors, lenders, owners, and others rely on the accuracy of this information when making future investing, lending, and growth decisions. When one of these statements is inaccurate, the financial implications are great. As the name suggests, it includes deductions with respect to the tax liabilities.

- Ensuring the adjusted trial balance report is presented in a clear, organized way will make it easier for you when it comes to preparing your financial statements at the end of the year.

- Just like in an unadjusted trial balance, the total debits and credits in an adjusted trial balance must equal.

- Budgeting foremployee salaries, revenue expectations, sales prices, expensereductions, and long-term growth strategies are all impacted bywhat is provided on the financial statements.

- We are using the same posting accounts as we did for the unadjusted trial balance just adding on.

- Once you’ve double checked that you’ve recorded your debit and credit entries transactions properly and confirmed the account totals are correct, it’s time to make adjusting entries.

- As before, the adjusted trial balance is a listing of all accounts with the ending balances and in this case it would be adjusted balances.

First method – inclusion of adjusting entries into ledger accounts:

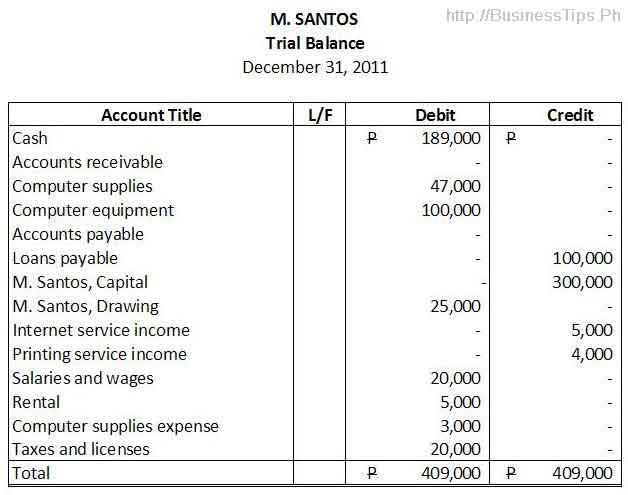

However, it is the source document if you are manually compiling financial statements. In the latter case, the adjusted trial balance is critically important – financial statements cannot be constructed without it. After adjusting entries are made, an adjusted trial balance can be prepared. There were no Depreciation Expense and Accumulated Depreciation in the unadjusted trial balance. Because of the adjusting entry, they will now have a balance of $720 in the adjusted trial balance. Utilities Expense and Utilities Payable did not have any balance in the unadjusted trial balance.

Ifthe final balance in the ledger account (T-account) is a creditbalance, you will record the total in the right column. Once all ledger accounts and their balances are recorded, the debit and credit columns on the adjusted trial balance are totaled to see if the figures in each column match. Adjusted trial balance is not a part of financial statements; rather, it is a statement or source document for internal use. It is mostly helpful in situations where financial statements are manually prepared. If the organization is using some kind of accounting software, the bookkeeper or accountant just needs to pass the journal entries (including adjusting entries).

After posting the above entries, they will now appear in the adjusted trial balance. Let’s now take a look at the T-accounts and unadjusted trial balance for Printing Plus to see how the information is transferred from the T-accounts to the unadjusted trial balance. An adjusted trial balance is prepared using the same format as that of an unadjusted trial balance. In Completing the Accounting Cycle, we continue our discussion of the accounting cycle, completing the last steps of journalizing and posting closing entries and preparing a post-closing trial balance. Once the trial balance information is on the worksheet, the next step is to fill in the adjusting information from the posted adjusted journal entries. Ending retained earnings information is taken from the statement of retained earnings, and asset, liability, and common stock information is taken from the adjusted trial balance as follows.